Investment Options for the ScholarShare 529 Plan. ScholarShare 529 allows you to invest in a range of portfolios with underlying funds that leading financial institutions, like TIAA-CREF, T. Rowe Price, Vanguard and others, manage the allocations of. Your portfolio options span age-based, multi-fund, single-fund and guaranteed portfolios.

How Much Should You Have In A 529 Plan By Age

Dec 8, 2023The Golden State has saved over $13.8 billion for college through the California 529. Read about the plan’s rules for participation. … Fittingly, you can contribute up to $529,000 in total to California’s 529 plan. You can use the California 529 to pay for college expenses in any state. Qualified withdrawals from a 529 plan are tax-exempt.

Source Image: honeyandlime.co

Download Image

Jan 12, 2024How to open a 529 plan. The first step is to understand who’s eligible. While 529 accounts are generally established by parents or grandparents on behalf of a child (the account’s beneficiary), anyone can open a 529 plan to fund educational expenses now or in the future. Similarly, anyone can be the beneficiary of a 529 plan as long as they

Source Image: calkids.org

Download Image

What Is A 529 Plan and Where to Open One in Your State Jan 19, 2024In fact, even the person opening the 529 plan can be its beneficiary. 3. Open the account. Most accounts can be opened online. Once opened, you can deposit funds directly into the account, and

Source Image: youtube.com

Download Image

How To Set Up A 529 Plan In California

Jan 19, 2024In fact, even the person opening the 529 plan can be its beneficiary. 3. Open the account. Most accounts can be opened online. Once opened, you can deposit funds directly into the account, and Jan 6, 2024Start the Process. When you’ve decided on the plan you want, go to the respective landing webpage for your state or brokerage firm’s 529 plan. There should be a button labeled “Enroll Now” or

ScholarShare California’s 529 College Savings Plan – YouTube

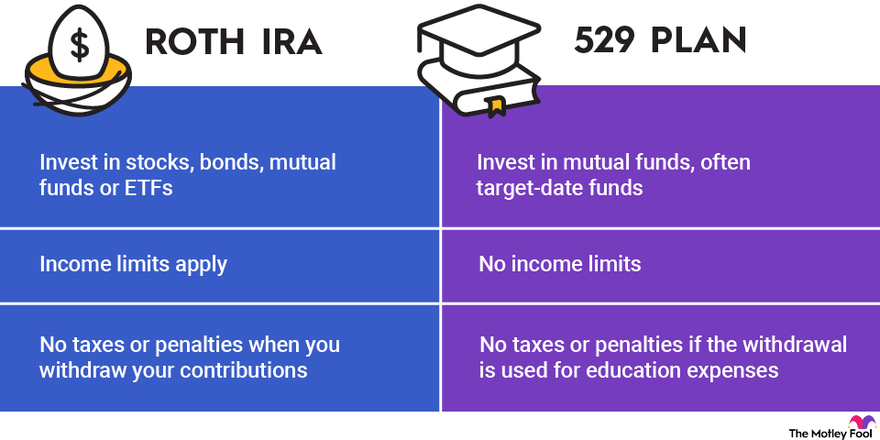

5 days ago3. Complete the 529 Plan Application. When you are ready to choose a 529 plan, Saving For College’s enroll now tool helps you open an account online. Just click on the “Enroll Now” button adjacent to the 529 plan’s listing. It will take you directly to the online application form for opening a 529 plan account. Roth IRA vs. 529 Plan for College Savings: Which Is Better? | The Motley Fool

Source Image: fool.com

Download Image

Welcome to ScholarShare 529 5 days ago3. Complete the 529 Plan Application. When you are ready to choose a 529 plan, Saving For College’s enroll now tool helps you open an account online. Just click on the “Enroll Now” button adjacent to the 529 plan’s listing. It will take you directly to the online application form for opening a 529 plan account.

Source Image: scholarshare529.com

Download Image

How Much Should You Have In A 529 Plan By Age Investment Options for the ScholarShare 529 Plan. ScholarShare 529 allows you to invest in a range of portfolios with underlying funds that leading financial institutions, like TIAA-CREF, T. Rowe Price, Vanguard and others, manage the allocations of. Your portfolio options span age-based, multi-fund, single-fund and guaranteed portfolios.

Source Image: thecollegeinvestor.com

Download Image

What Is A 529 Plan and Where to Open One in Your State Jan 12, 2024How to open a 529 plan. The first step is to understand who’s eligible. While 529 accounts are generally established by parents or grandparents on behalf of a child (the account’s beneficiary), anyone can open a 529 plan to fund educational expenses now or in the future. Similarly, anyone can be the beneficiary of a 529 plan as long as they

Source Image: thecollegeinvestor.com

Download Image

California offers up to $225 to open college fund for a child – Los Angeles Times 4 days agoWhen considering a 529 plan in California, you must understand the tax laws that govern it. Unlike many other states, The Golden State does not provide a state income tax deduction for contributions made to a 529 plan.However, California’s 529 plans have generous contribution limits, allowing individuals to contribute up to $529,000 per beneficiary, over the account’s lifetime.

Source Image: latimes.com

Download Image

Secrets of the Alabama 529 college funding plan – al.com Jan 19, 2024In fact, even the person opening the 529 plan can be its beneficiary. 3. Open the account. Most accounts can be opened online. Once opened, you can deposit funds directly into the account, and

Source Image: al.com

Download Image

California Estate Planning | California Legal Resources | CEB Jan 6, 2024Start the Process. When you’ve decided on the plan you want, go to the respective landing webpage for your state or brokerage firm’s 529 plan. There should be a button labeled “Enroll Now” or

Source Image: store.ceb.com

Download Image

Welcome to ScholarShare 529

California Estate Planning | California Legal Resources | CEB Dec 8, 2023The Golden State has saved over $13.8 billion for college through the California 529. Read about the plan’s rules for participation. … Fittingly, you can contribute up to $529,000 in total to California’s 529 plan. You can use the California 529 to pay for college expenses in any state. Qualified withdrawals from a 529 plan are tax-exempt.

What Is A 529 Plan and Where to Open One in Your State Secrets of the Alabama 529 college funding plan – al.com 4 days agoWhen considering a 529 plan in California, you must understand the tax laws that govern it. Unlike many other states, The Golden State does not provide a state income tax deduction for contributions made to a 529 plan.However, California’s 529 plans have generous contribution limits, allowing individuals to contribute up to $529,000 per beneficiary, over the account’s lifetime.